Systematic Risk Is Defined As

Noun usually uncountable plural systematic risks 1.

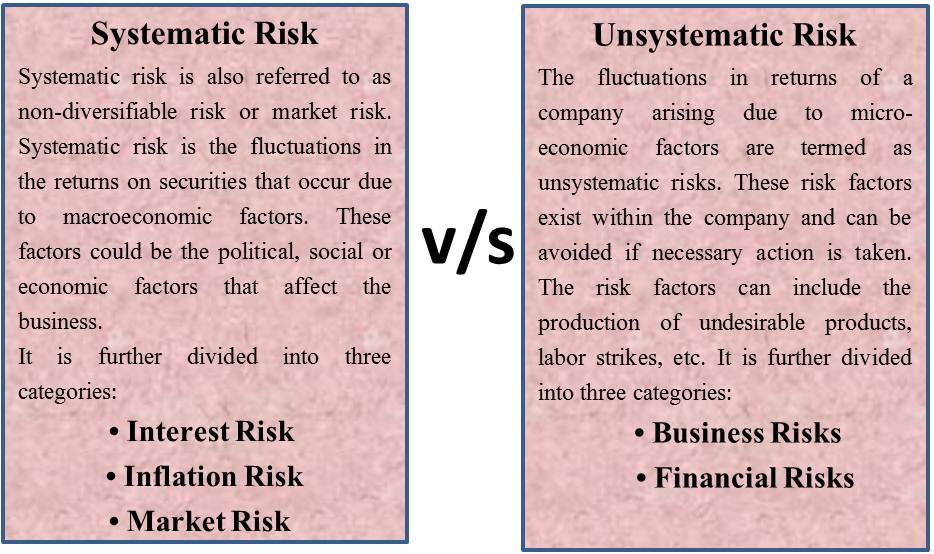

Systematic risk is defined as. Systemic risk is the possibility that an event at the company level could trigger severe instability or collapse an entire industry or economy. Systematic risk also called market risk is risk that s characteristic of an entire market a specific asset class or a portfolio invested in that asset class. Systematic risk also known as market risk is the risk that is inherent to the entire market rather than a particular stock or industry sector. Systemic risk definition is the risk that the failure of one financial institution such as a bank could cause other interconnected institutions to fail and harm the economy as a whole.

Finance the risk associated with an asset that is correlated with the risk of asset markets generally often measured as its beta. Systematic risk also known as market risk or volatility risk signifies the inherent danger in the unexpected nature of the market.